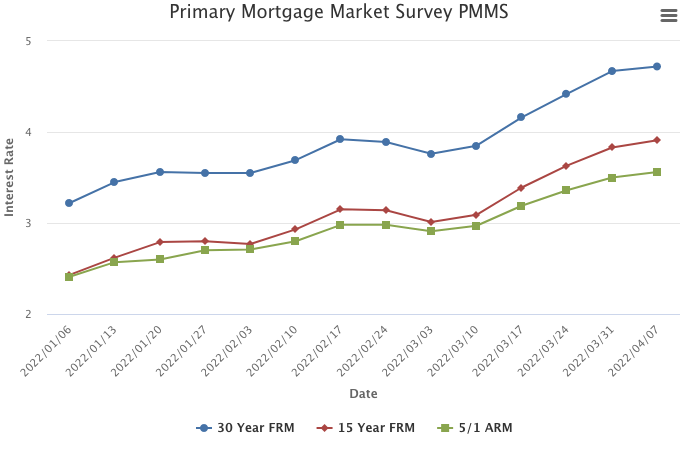

April 7, 2022

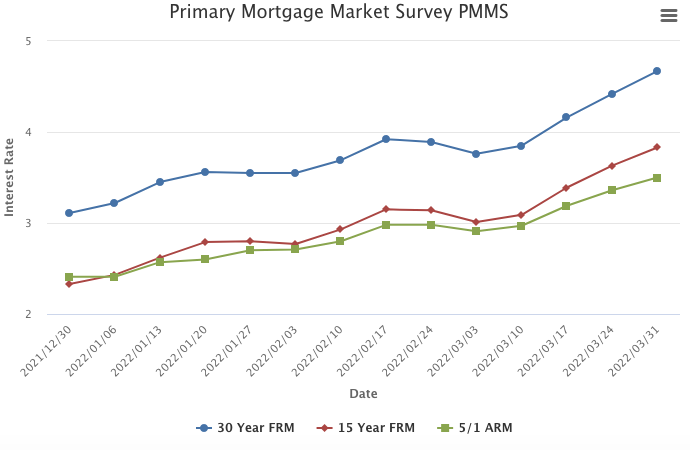

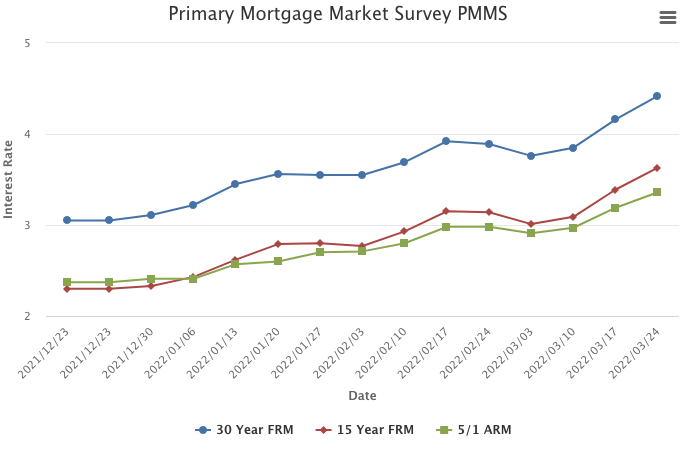

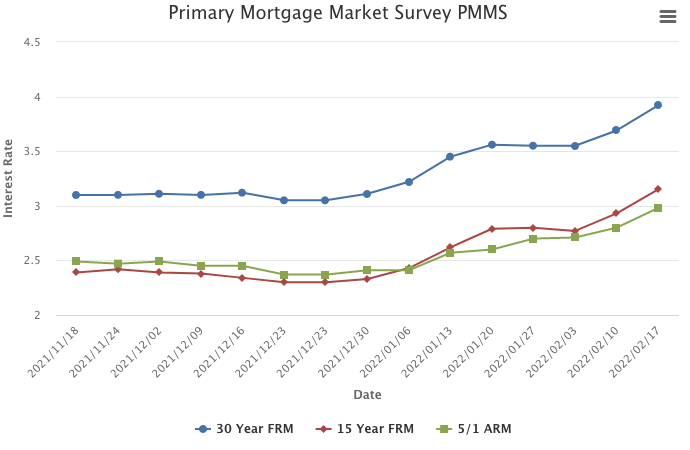

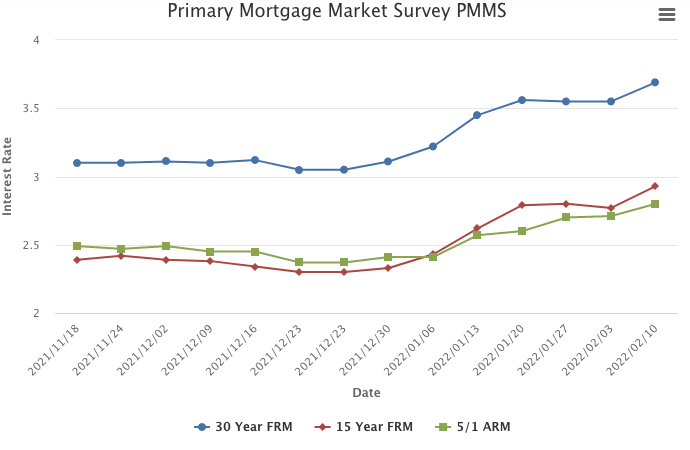

Mortgage rates have increased 1.5 percentage points over the last three months alone, the fastest three-month rise since May of 1994. The increase in mortgage rates has softened purchase activity such that the monthly payment for those looking to buy a home has risen by at least 20 percent from a year ago.

Information provided by Freddie Mac.