April 6, 2023

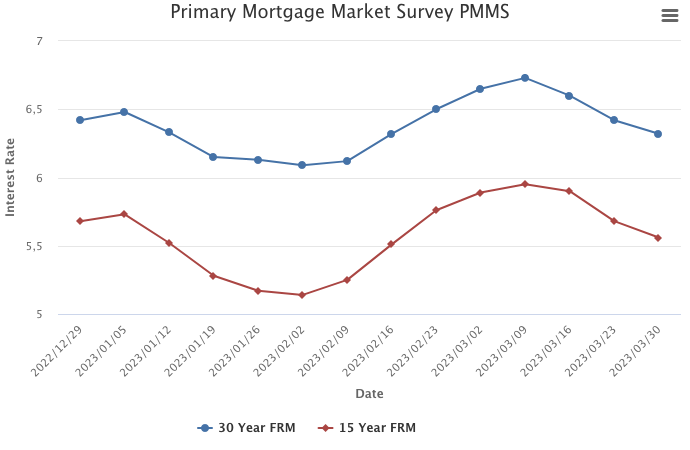

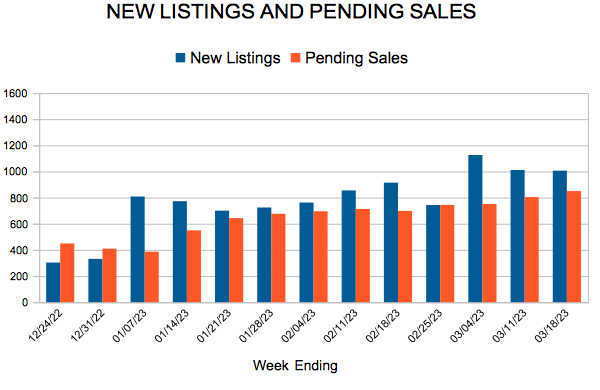

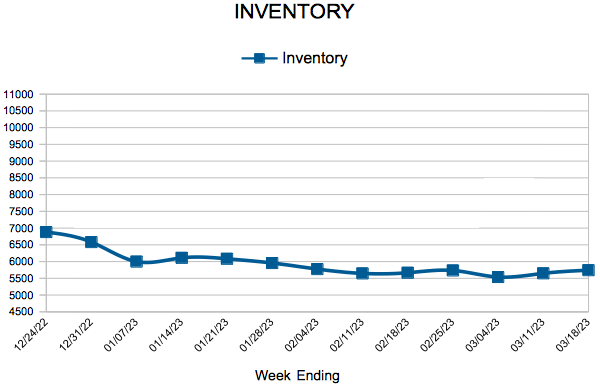

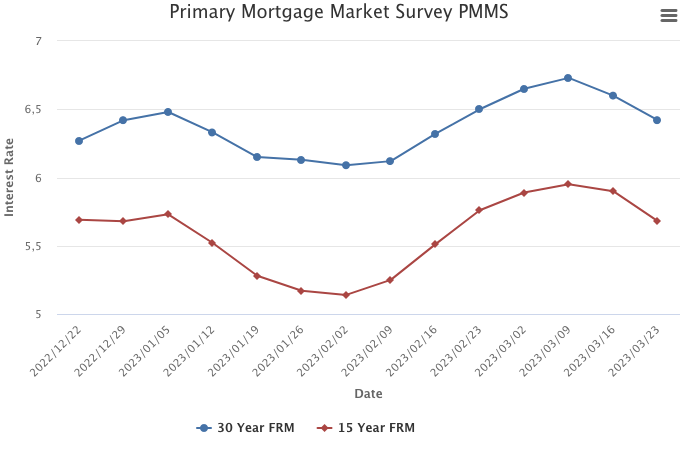

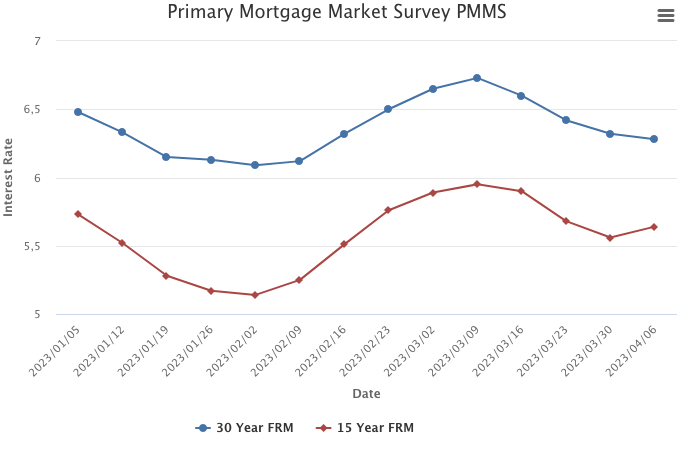

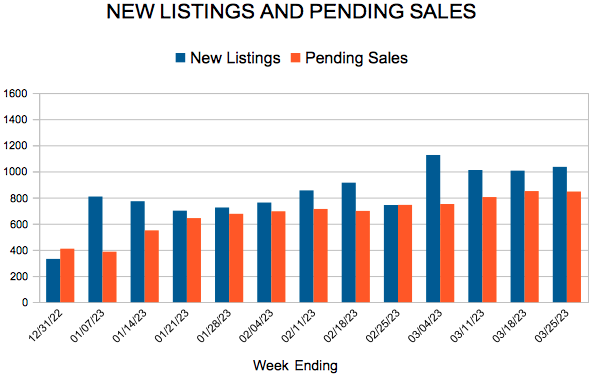

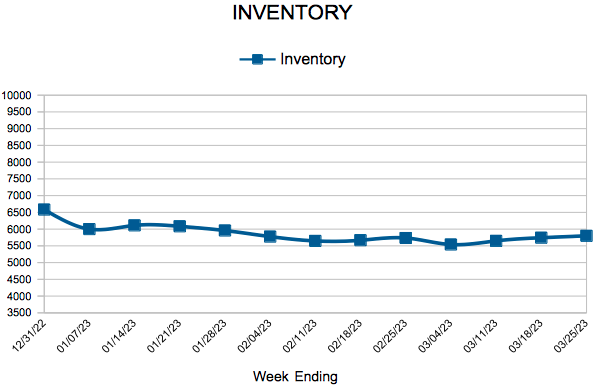

Mortgage rates continue to trend down entering the traditional spring homebuying season. Unfortunately, those in the market to buy are facing a number of challenges, not the least of which is the low inventory of homes for sale, especially for aspiring first-time homebuyers.

Information provided by Freddie Mac.

For Week Ending March 25, 2023

For Week Ending March 25, 2023