For Week Ending March 11, 2023

For Week Ending March 11, 2023

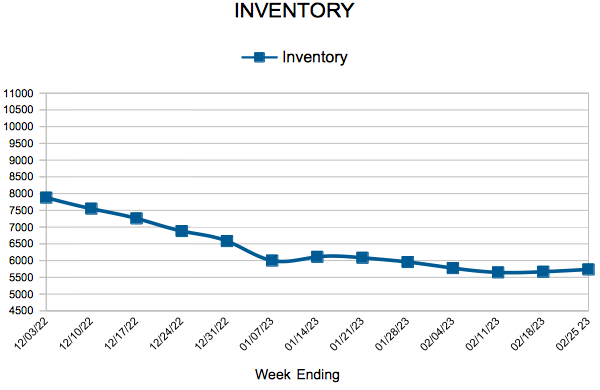

The slower pace of home sales has helped housing supply increase at a record pace nationwide, with inventory climbing 67.8% year-over-year in February, according to Realtor.com’s latest Monthly Housing Market Trends report. Inventory was up in 49 out of 50 of the largest US metros, driven largely by increased time on market and a decrease in buyer demand due to elevated borrowing costs. February marks the 6th consecutive month the supply of homes increased, although inventory remains down compared to pre-pandemic levels.

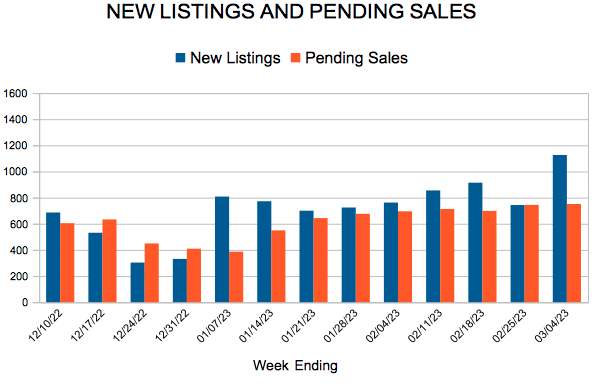

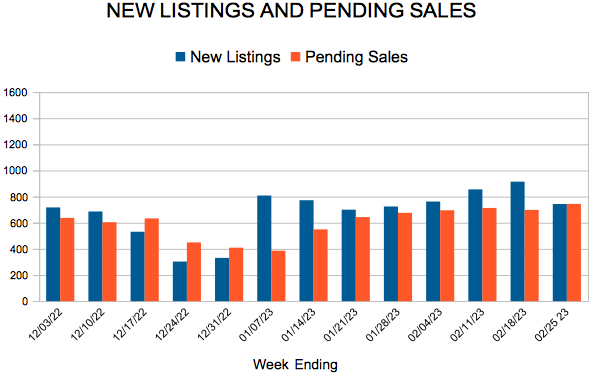

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MARCH 11:

- New Listings decreased 25.8% to 1,011

- Pending Sales decreased 31.7% to 804

- Inventory increased 10.4% to 5,649

FOR THE MONTH OF FEBRUARY:

- Median Sales Price increased 0.5% to $341,850

- Days on Market increased 38.6% to 61

- Percent of Original List Price Received decreased 3.6% to 97.2%

- Months Supply of Homes For Sale increased 44.4% to 1.3

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.