For Week Ending October 16, 2021

For Week Ending October 16, 2021

The supply of entry-level housing is at its lowest level in nearly five decades, according to Freddie Mac, who reports that entry-level home construction decreased from 418,000 units per year in the 1970s to 65,000 units per year in 2020. The shortage of starter homes has proven challenging to first-time buyers, as many existing entry-level homes are being remodeled or demolished and replaced by much larger homes, while those that remain have become significantly more expensive, with sales prices increasing 64% from 2016, according to realtor.com.

In the Twin Cities region, for the week ending October 16:

- New Listings decreased 10.4% to 1,433

- Pending Sales decreased 12.7% to 1,305

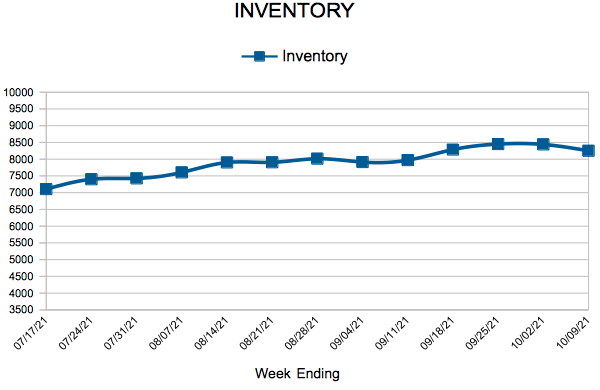

- Inventory decreased 16.8% to 8,159

For the month of September:

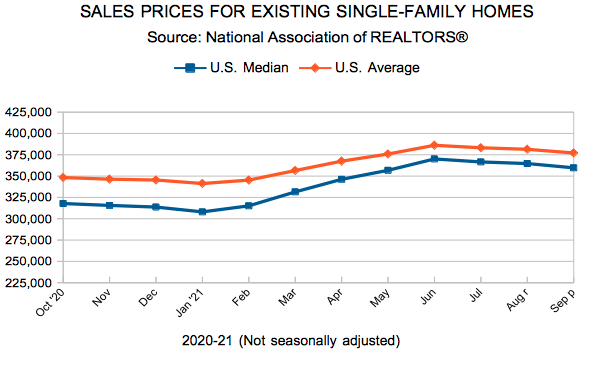

- Median Sales Price increased 10.0% to $341,000

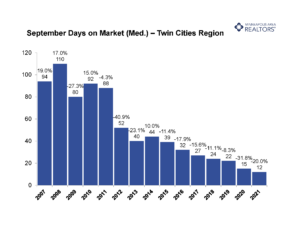

- Days on Market decreased 37.8% to 23

- Percent of Original List Price Received increased 0.7% to 101.2%

- Months Supply of Homes For Sale decreased 21.1% to 1.5

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.