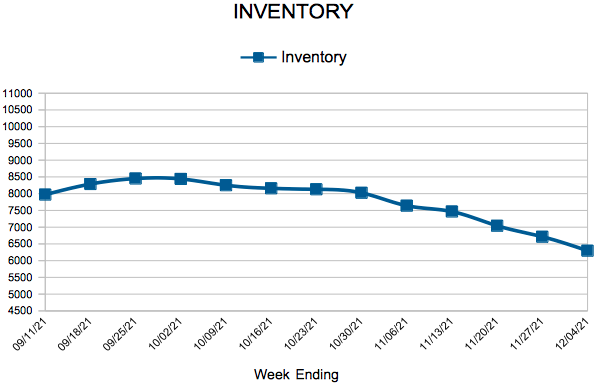

Inventory

Weekly Market Report

For Week Ending December 11, 2021

For Week Ending December 11, 2021

With developable lots in short supply across the country, home builders are finding other ways to meet booming buyer demand. According to the most recent Annual Builder Practices Survey, one in four new single-family detached homes built in 2020 were located in established neighborhoods, with 19% of those homes built on infill lots, while 6% were teardowns. Demand for single-family homes continues to outpace supply, and infill development is expected to increase in market share in 2022 as builders ramp up production.

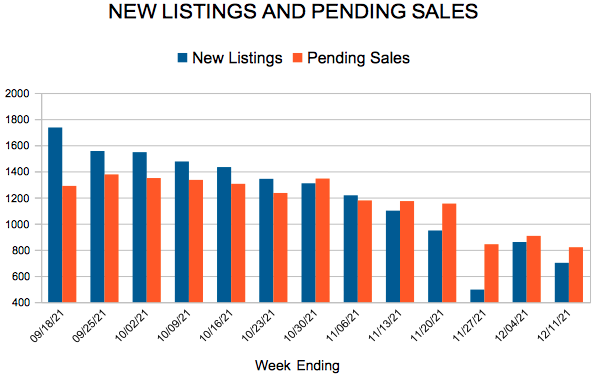

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 11:

- New Listings decreased 21.4% to 701

- Pending Sales decreased 4.5% to 820

- Inventory decreased 17.3% to 5,965

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 9.5% to $339,300

- Days on Market decreased 11.8% to 30

- Percent of Original List Price Received decreased 0.4% to 99.8%

- Months Supply of Homes For Sale decreased 21.4% to 1.1

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

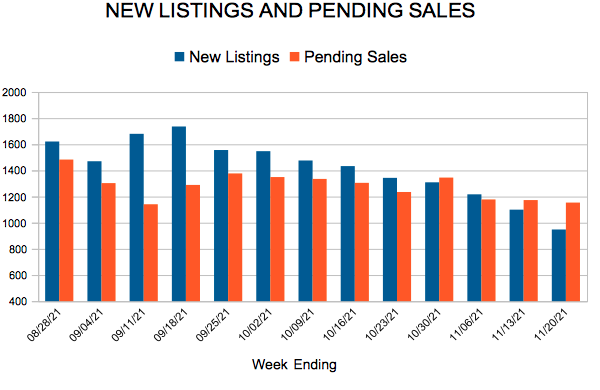

New Listings and Pending Sales

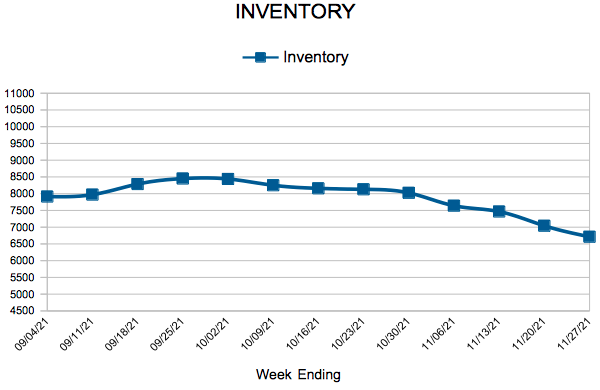

Inventory

Weekly Market Report

For Week Ending December 4, 2021

For Week Ending December 4, 2021

The latest REALTORS® Confidence Index Survey found that, nationally, sellers of homes that closed in October saw 3.7 offers on average, which was up from 3.4 offers on average a year ago. The survey also found the typical buyer had made two unsuccessful offers before securing their new home, and that first-time buyers accounted for 29% of existing-home buyers, down from 32% a year ago. Cash purchases rose to 24% of sales from 19% one year ago, and non-primary residence buyers (investors and second home buyers) rose to 17% from 14% in 2020.

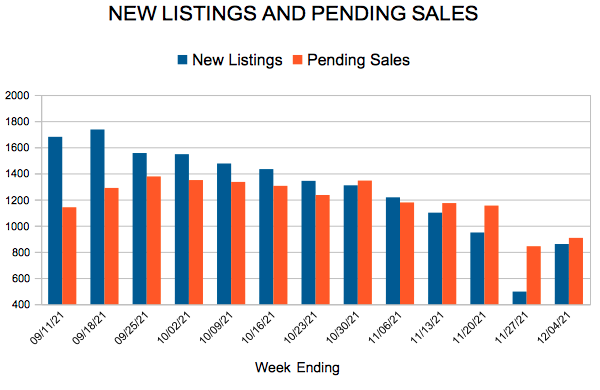

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 4:

- New Listings decreased 1.0% to 860

- Pending Sales decreased 12.5% to 907

- Inventory decreased 16.1% to 6,297

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 7.9% to $340,000

- Days on Market decreased 22.9% to 27

- Percent of Original List Price Received decreased 0.2% to 100.3%

- Months Supply of Homes For Sale decreased 17.6% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending November 27, 2021

For Week Ending November 27, 2021

With showings, contract signings, and closed sales remaining strong throughout fall, experts are expecting an especially busy housing market this winter, as buyers rush to beat rising rental prices and anticipated increases in mortgage rates. Total existing home sales will top 6 million in 2021, the highest level in 15 years, according to the National Association of REALTORS®, who predicts home prices will continue to increase in 2022, albeit at a gentler rate compared to the recordsetting pace of this year.

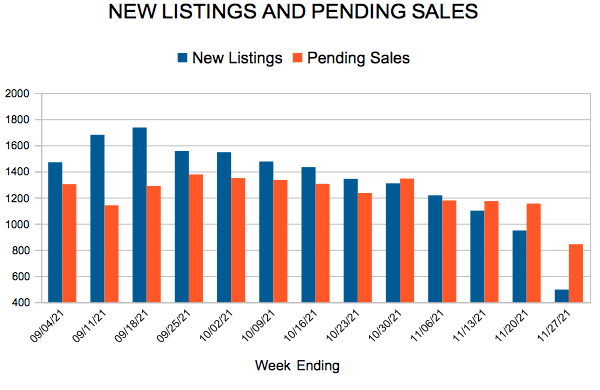

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 27:

- New Listings decreased 15.8% to 496

- Pending Sales decreased 0.8% to 843

- Inventory decreased 15.7% to 6,714

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 7.9% to $340,000

- Days on Market decreased 22.9% to 27

- Percent of Original List Price Received decreased 0.2% to 100.3%

- Months Supply of Homes For Sale decreased 17.6% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 84

- 85

- 86

- 87

- 88

- …

- 111

- Next Page »